The 12-month percentage change in core inflation has been going downhill...

... as is the CPI for all urban consumers stripped off food and energy components. Core inflation has fallen from more than 2 percent to less than 1 percent.

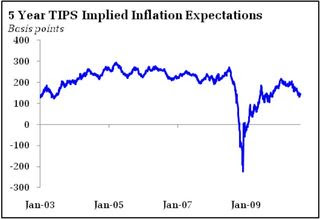

David Beckworth shows thee steeply declining trend in inflation expectations as reflected in the difference between 5 year treasury yields and 5 year TIPS for the

January 4, 2010 - July 15, 2010 period.

Menzie Chinn finds no signs of inflation with either annualized 3 month changes in price indices...

... inflation expectations from either Survey of Profession Forecasters...

... or from market-based measures of inflation expectations.

The Federal Reserve Bank of Cleveland reports that its latest estimate of 10-year expected inflation is 1.69%, or in other words, the public currently expects the inflation rate to be less than 2% on average over the next decade. This is borne out by the expected inflation yield curve.

On a historical perspective too nothing appears to have badly unsettled the inflation trend.

Paul Krugman points to the 10 year TIPS spreads (difference between the interest rate on ordinary government bonds and bonds indexed to inflation), which is a measure of the inflation rate, and finds much the same declining inflation trend

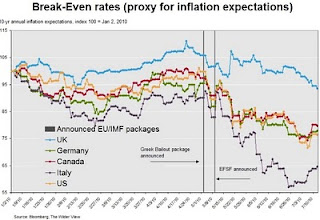

And Rebecca Wider finds that the trend is global, atleast among the developed economies. She illustrates using the respective inflation-indexed bond markets that the 10-yr break-even expected inflation rates for the UK, Germany, Canada, Italy, and the US are falling.

See also this and this by James Hamilton.

Update 1 (1/8/2010)

More evidence from Free Exchange which points to the continuously declining trend on the interest rates on 10 year US government debt.

Update 2 (3/8/2010)

University of Michigan estimates (survey-based) of inflation expectations appear to indicate that they are currently well anchored. Indeed, except the early 1980's which experienced a period of rapid disinflationary expectations, expectations have been relatively stable.

Financial market inflation expectations, as manifested in the difference between 5 year Treasuries and 5 year TIPS fell slightly in recent months, but nothing like the clear taste of deflationary expectations at the end of 2008. It too appears to be well anchored.

Update 3 (4/8/2010)

David Beckworth has a series of graphs on falling inflation expectations.

Update 4 (10/8/2010)

Menzie Chinn finds that over certain horizons, we already have deflation; and for certain segments of the population, inflation has been at zero for a year already.

No comments:

Post a Comment