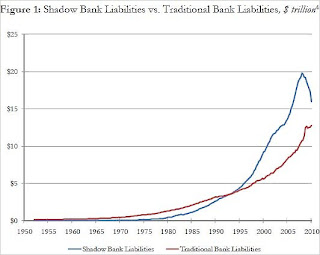

This comes from a New York Fed working paper (via Economix) by Zoltan Pozsar, Tobias Adrian, Adam Ashcraft, and Hayley Boesky. They define shadow banks as

"Financial intermediaries that conduct maturity, credit, and liquidity transformation without access to central bank liquidity or public sector credit guarantees. Examples of shadow banks include finance companies, asset-backed commercial paper (ABCP)conduits, limited-purpose finance companies, structured investment vehicles, credit hedge funds, money market mutual funds, securities lenders, and government-sponsored enterprises...

The shadow banking system rivals the traditional banking system in the intermediation of credit to households and businesses. Over the past decade, the shadow banking system provided sources of inexpensive funding for credit by converting opaque, risky, long-term assets into money-like and seemingly riskless short-term liabilities. Maturity and credit transformation in the shadow banking system thus contributed significantly to asset bubbles in residential and commercial real estate markets prior to the financial crisis."

And about how the shadow banking system contributed to the crisis,

"The shadow banking system became severely strained during the financial crisis because, like traditional banks, shadow banks conduct credit, maturity, and liquidity transformation, but unlike traditional financial intermediaries, they lack access to public sources of liquidity, such as the Federal Reserve’s discount window, or public sources of insurance, such as federal deposit insurance. The liquidity facilities of the Federal Reserve and other government agencies’ guarantee schemes were a direct response to the liquidity and capital shortfalls of shadow banks and, effectively, provided either a backstop to credit intermediation by the shadow banking system or to traditional banks for the exposure to shadow banks."

Update 1 (4/6/2011)

Economist has this graphic about the global outstanding OTC derivatives. According to the Bank for International Settlements (BIS), it stood at $601 trillion in December 2010, up from $583 trillion six months earlier.

1 comment:

We dont seem to have too many such shadow banks in India . Any ideas?

Post a Comment