Economists like Robert Shiller argue that equities remain at levels higher than their historic levels. They claim that government interventions in the economy and the equity markets in 1998, 2001 and 2008 have kept stocks from fully correcting, and there are ample signs that bubbles are starting to inflate again, notably in certain developing-country stocks. They point to the fact that despite the two bear markets, stocks have spent almost all their time since 1991 priced above historic averages, thereby increasing the probability of declines.

Prof Shiller has compiled market data back to 1881, measuring stock prices month by month relative to corporate profits, and to avoid short-term profit distortions, he uses an average of profits over the previous 10 years. Whereas over the long run, by this measure, stocks trade at an average of about 16 times annual corporate profits (that is, their price-to-earnings ratio, or P/E ratio, is about 16), the current PE ratio is above 20. Of even greater concern is the fact that since 1991 the S&P 500 has spent only seven months, in late 2008 and early 2009, below the average level of 16.

There are other like Wharton's Prof Jeremy Siegel, who argue that the steep correction of 2008-09 means that stocks continue to remain very cheap. Prof Siegel argues that Shiller's use of 10-year average profits works poorly in the current environment, because big financial companies took such heavy write-offs in 2008 and 2009.

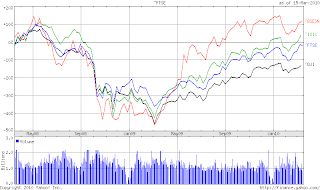

In any case, as this graphic (BSE Sensex, NASDAQ, DJIA, and FTSE) indicates, despite all talks of de-coupling, the global equity markets have been strongly coupled over the last two years, in both the meltdown on 2008 and the recovery of 2009.

Update 1 (21/3/2010)

The Times feels that the second year of the bull market rally from March 2010 may not be as productive as the 70% increase shown by the S&P 500 for the same period last year. It points to a Merrill Lynch estimate that the second years of rallies are almost always less fruitful than the first, with only twice the S&P 500 index gaining more than 12% in the second year after a market bottom and the average gain being just 9%. In the second year after the most recent bears in this category — which spanned from 1980-82 and 2000-02 — stocks gained only 2% and 8% respectively.

Encouraging news is that bull market rallies generally go beyond the first year (Merrill's estimate is that in nine of the last 10 market recoveries going back to 1932, stocks gained ground in the second year after a bear market) and two decades of bear market is very rare (The S&P 500 peaked after the long bull market run of 1990s at 1,527 on March 24, 2000. Today it stands 24% lower, at 1,159. The last instance of two decades of bear market happened in 1929).

As aforementioned, Robert Shiller uses the 10-year average corporate profits to calculate the market’s price-to-earnings (P/E) ratio to be 20.6, noticeably higher than the historical average of 16. He finds that in periods when the market’s P/E ratio has been between 19 and 25, the average real return for stocks over the subsequent decade has been 3.8% after inflation. Assuming inflation is around 3%, stocks are likely to return less than 7% for this decade, which is lower than their long-term historical gain of around 10% a year.

See also this Global Investment Returns Yearbook for 2009 from Credit Suisse.

No comments:

Post a Comment